Squirrel Banking App

Finances can be a blessing and a curse for young people, but knowing the basics can help prepare them for life as an adult. Only four states (Virginia, Tennessee, Missouri, and Utah) require high school students to complete a stand-alone course in personal finances to graduate high school, but unfortunately, most are not exposed to this at home or school. Squirrel serves as a subsidiary of a larger banking institution whose goal is to develop good financial skills for young people while allowing some involvement from parents.

Timeline

5 Weeks

My Role

User Interface Design

User Experience Design

Web Design

Branding

Tools

Illustrator

Photoshop

XD

Collaborators

Lindsey Jensen

Project Problem

Money can be hard to talk to anyone about, especially tweens. As they pursue a higher degree of independence, parents are faced with the challenge of instilling financial literacy and money management skills to help their children learn as they grow. Current offerings do not provide a full-service solution that provides the flexibility to guide their children through the process of developing healthy money habits.

Research

In order to develop a better understanding of our audience, we conducted interviews with parents and tweens as well as creating a short survey. Our goal was to better gauge the potential pain points and determine what features would be useful for tweens and parents to help facilitate a feeling of financial independence and open communication.

Interview Results

- Two tweens, ages 10 and 14

- Both have bank accounts; neither have debit cards

- Kids share an iPad; the 14-year-old has an iPhone

- Notices the popularity of YouTube with her kids and thinks that tutorials and short, tween-friendly videos would get their attention and help them learn financial literacy

Easy money transfers

“I want to transfer money between my account to my children’s account, and vice versa, to pay them for chores, and for them to pay me back when I buy something they wanted.”

To encourage mindful habits

“Structure in learning to save would be great. I like to encourage mindful spending.”

To teach how to prioritize spending

“Tweens are too young for budgeting meals and other essentials because they don’t have substantial regular incomes, but they should be learning how to manage and prioritize goals.”

What is monetary value

“My children are becoming aware of what things cost. I encourage this because someday they will be financially independent. For now, if they want to save for something, they should be learning how to compare prices.”

Bring about awareness of the working world

“It would be great to see my kids excited to seek job opportunities. Starting to build confidence and ability to function in the workplace.”

- Has her own bank account and debit card

- Has own iPhone, iPad, Kindle and uses the family computers

- Expressed interest in gaining financial independence with guidance

- Thinks it is important to be able to research the things you are saving up for to know how much they cost before thinking about purchasing it

Enjoys learning through games

“At school, we learned about the Bill of Rights by playing games.”

Wants access to knowledge

“I should have the option to learn more when something interests me.”

Would enjoy financial journal or chatbot

“I feel safe talking to my parents but would use a chat room because sometimes writing your thoughts is easier than trying to talk to someone.”

Condones transparency

“I think it’s important for my parents to see what I’m spending so they can hold me accountable.”

Wants parental encouragement

“If my parents know what I’m saving for, they may want to help me save and support my goal!”

Survey Results

Surveyed parents want an application that teaches kids about saving and budgeting

Surveyed parents want resources to facilitate a healthy conversation with their children

Surveyed parents want total visibility over their children’s banking activity and spending

Project Goals

Financial Literacy

Provide users with materials that help promote financial literacy and understanding

Incentivize Saving

Interfaces designed to incentivizing savings and goal setting for young adults without being overbearing or repetitive

Facilitate Conversation

Offer a system that facilitates financial conversations between parents and children

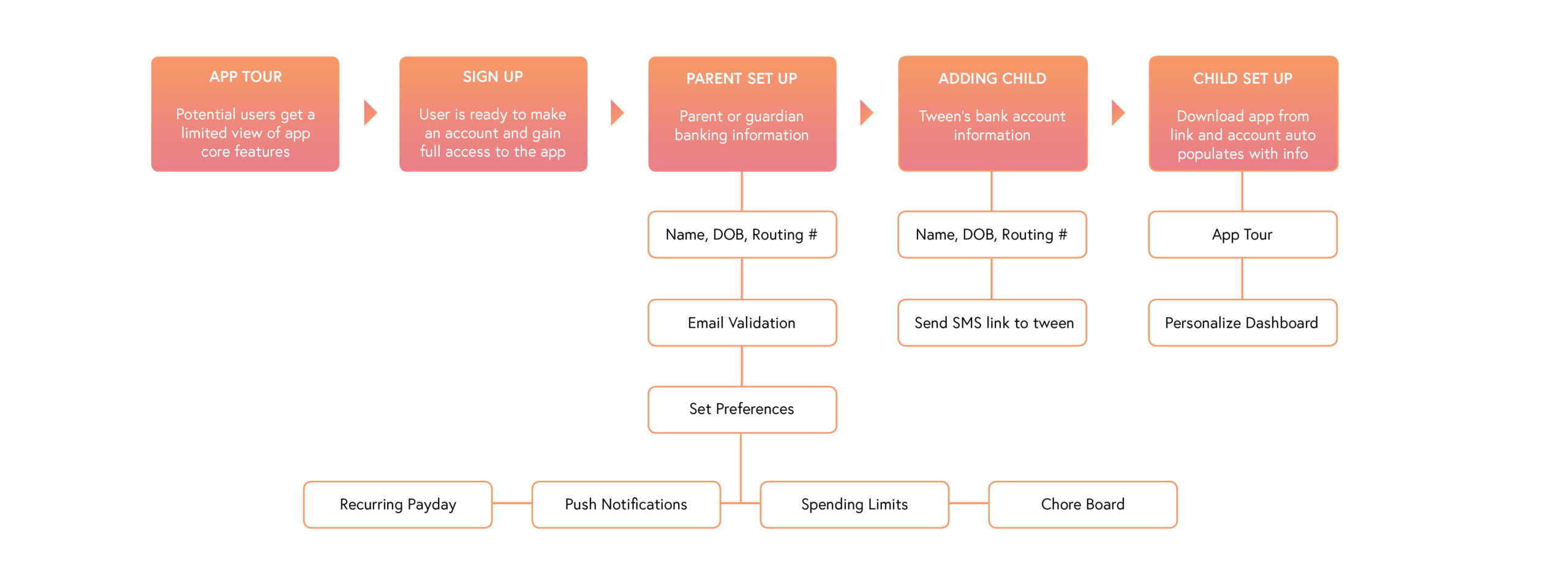

User Journey

The Solution

Squirrel Banking was designed to create a frictionless environment that gives tweens the ability to pursue financial independence while providing parents with a platform to instill healthy money habits and insight conversation. Users can integrate existing bank accounts, create savings goals and learn more about important financial topics via the app.

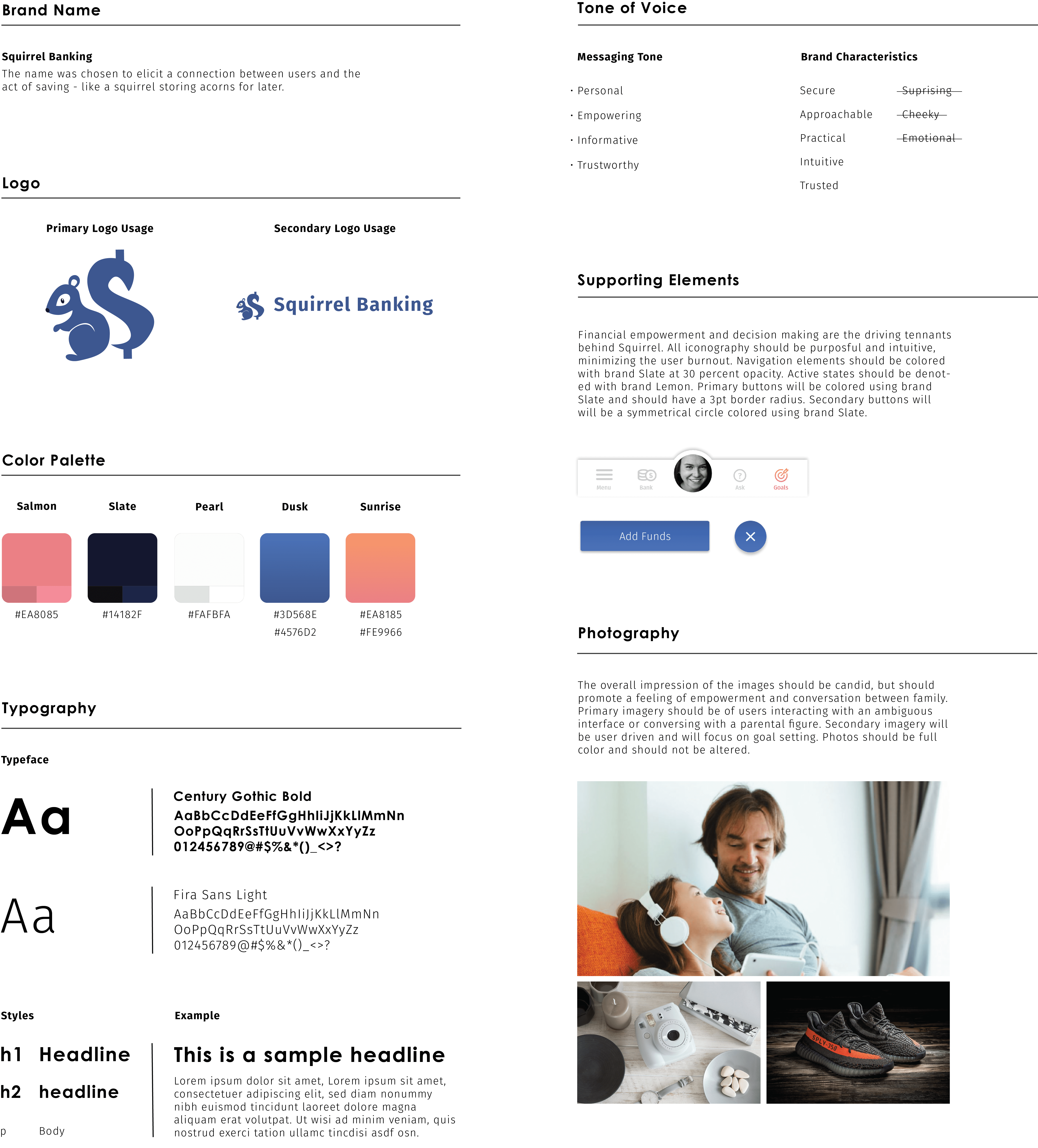

Design System

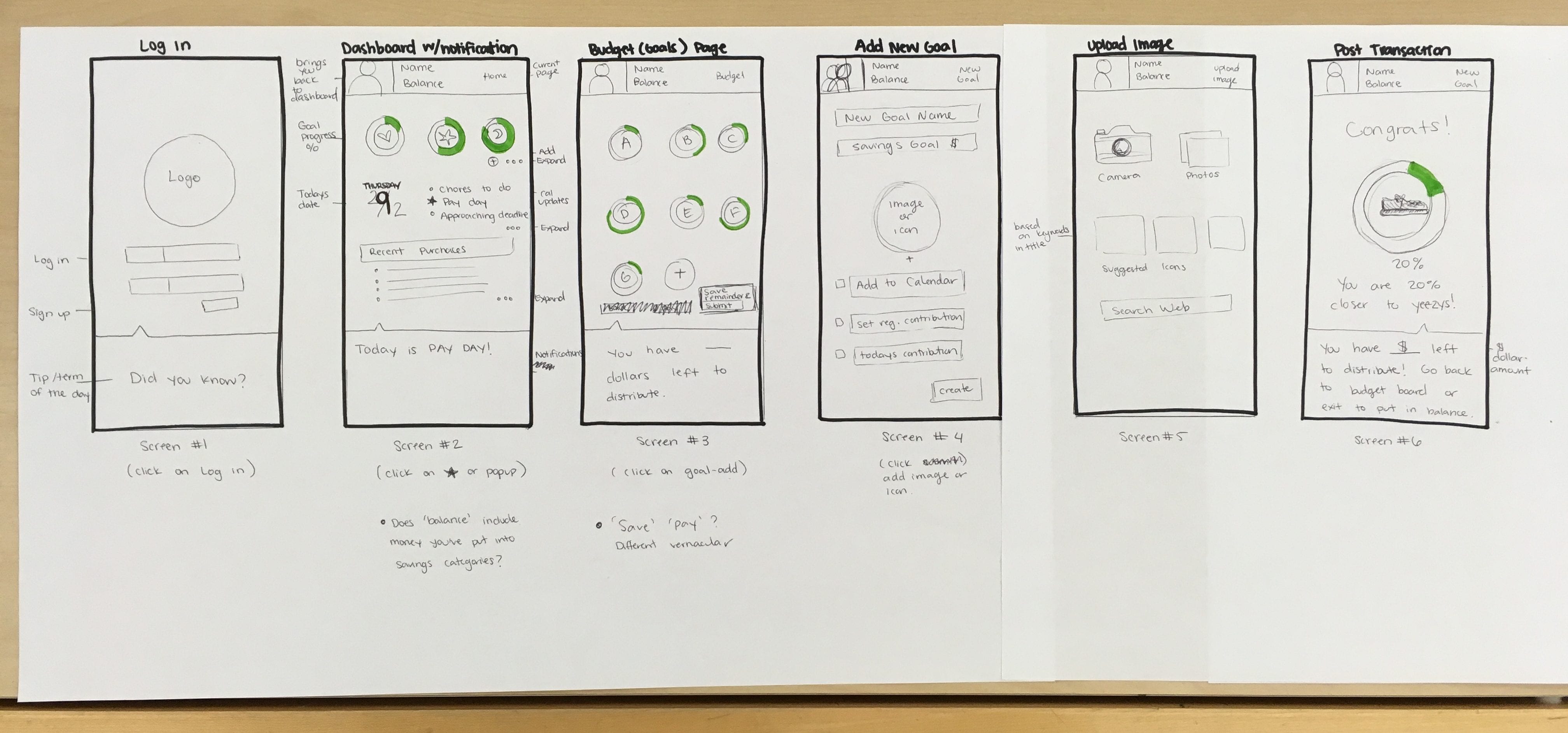

Low Fidelity Wireframes

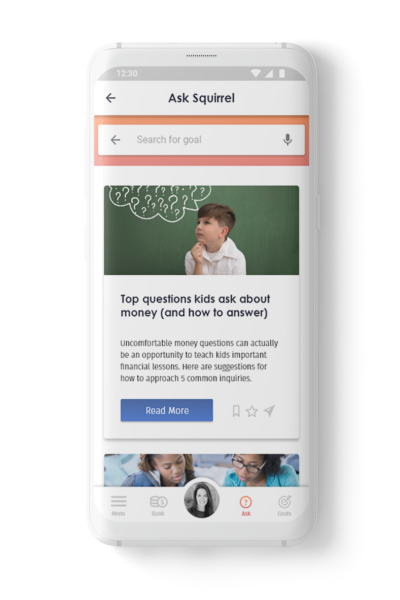

Financial Literacy

Squirrel allows the tween a variety of approaches to seek financial information. The app features a news feed of fun articles, videos, and blogs accessible from the menus tab for both parent and child. Parents may also select articles and add them to the child’s feed or use them to start a direct message conversation.

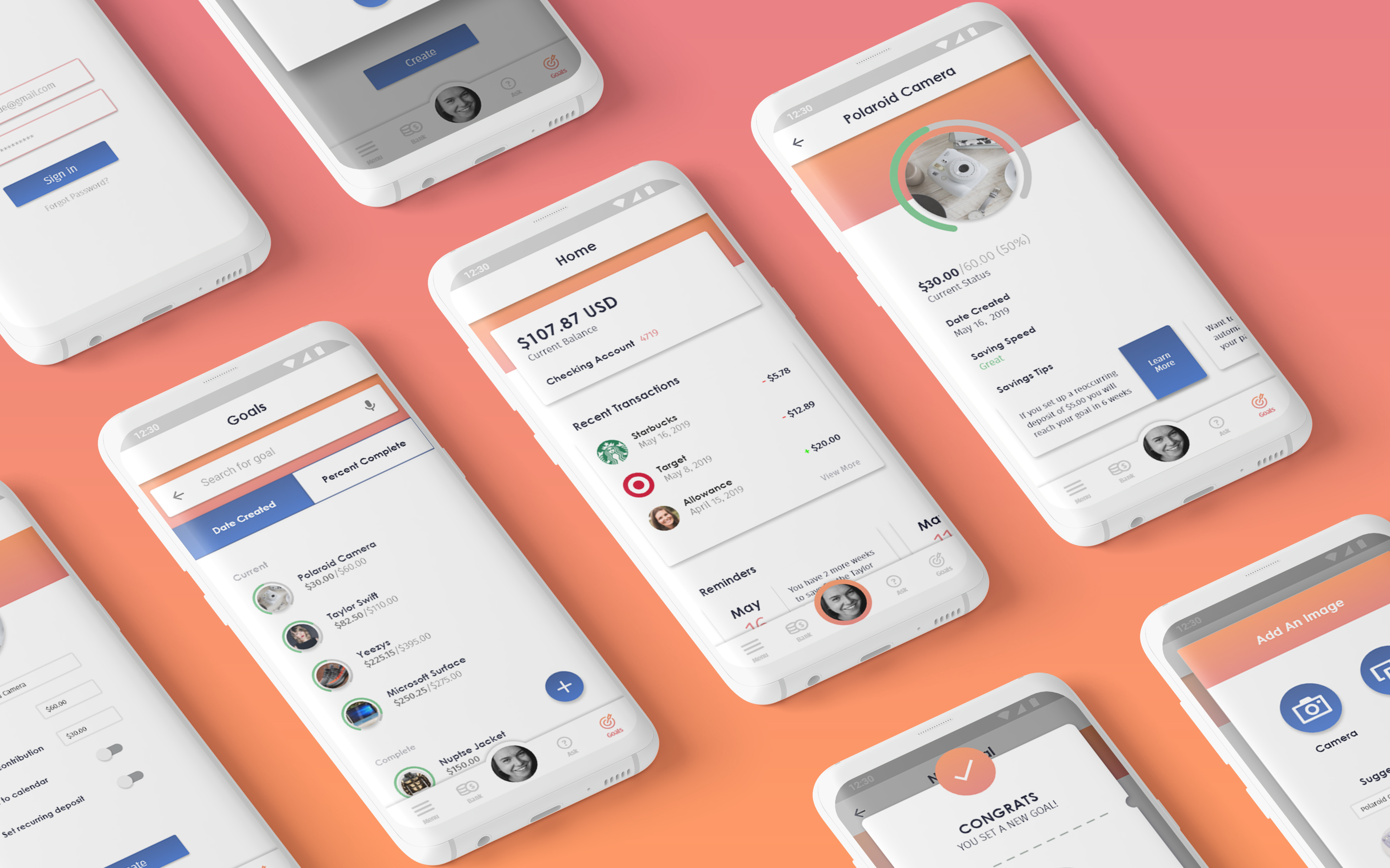

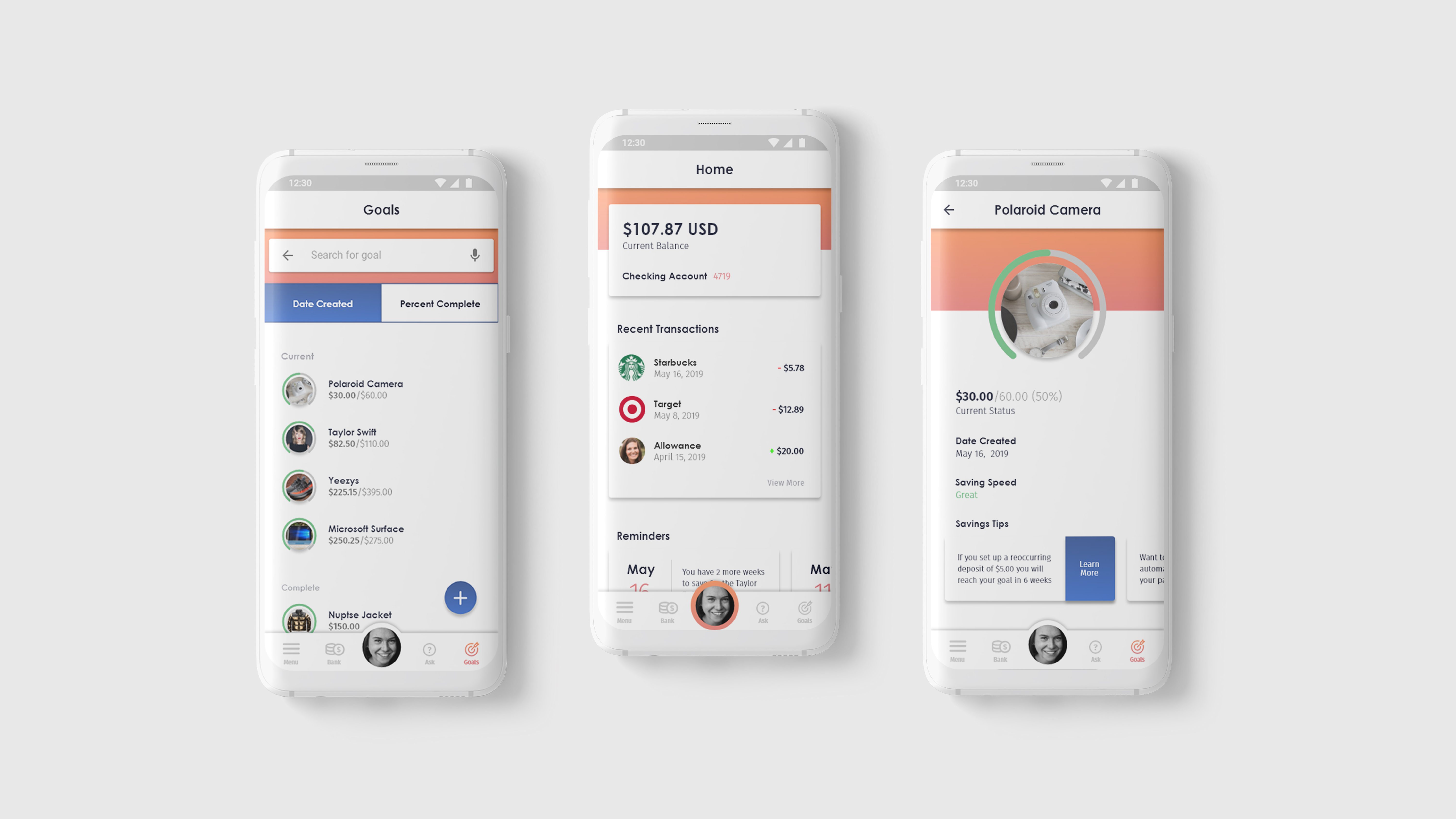

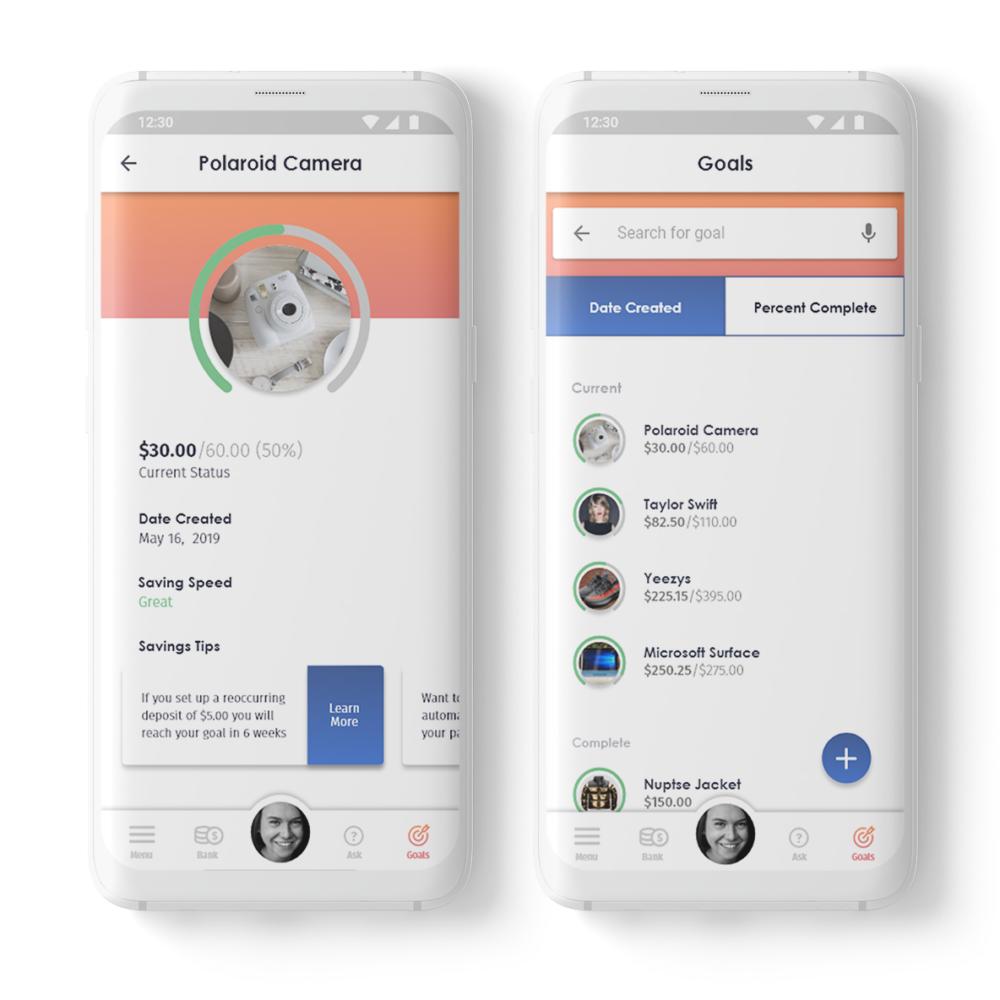

Goal Setting

A tween user-friendly dashboard displays a basic overview of the user’s current and completed savings goals and allows them to create new goals with parent consent. The dashboard expands into more detailed screens and includes gamification elements. With all information accessible, the tween can learn to make financial decisions and allocate money into savings goals.

Financial Conversation

The message feature in Squirrel allows tweens to feel confident in starting conversations and asking questions. With ongoing conversations the tween is able to work at their own pace and alleviating any stress or resistance money talk can often create.

Landing Page

The landing page for Squirrel Banking was designed to be both visually appealing and help drive conversions. The visual tone and marketing copy take a casual tone and are geared towards parents of tweens who are looking to instill healthy money habits with their children. Users are guided through the key features of the application and are prompted to download the app via multiple calls to action.

Prototype

The prototype was designed to show the flow of a tween user navigating to and setting up a new savings goal. Savings goals are meant to help instill healthy money habits while inspiring users to budget and save money for the things they want.